Inventory is low. Prices are high. Where do we go from here?

As real estate professionals, we are often faced with the question, “So, how’s the market?” For the past three years, the answer has been pretty consistent: “Demand is high, inventory is low, and prices are escalating quickly.”

And with seasonality patterns by the wayside and a pandemic fueling work-from-home careers, it didn’t matter what time of year the conversation occurred.

However, we started to see the change a year ago, in 3Q2022.

While demand remained strong, rising interest rates and increased values served as a double hit on many would-be homebuyers, increasing their cost of borrowing and decreasing their purchasing power. The number of multiple offer sales showed some modest decline and, occasionally, a property would require a price drop to stimulate a sale. Now that we’re one year into this pattern we can better track YTD trends more closely vs the same period last year and answer a new question.

Is the market slowing?

National data from the National Association of REALTORS® certainly seems to say so, with the total number of home sales falling to below a 4 million unit annual average for the first time since the Great Recession of 2008. But, is that universally true? If we define “softening” as a decline in activity, then yes, clearly our market is also experiencing a downward shift driven largely by our substantial supply issue. However, buyer activity has held up, until very recently.

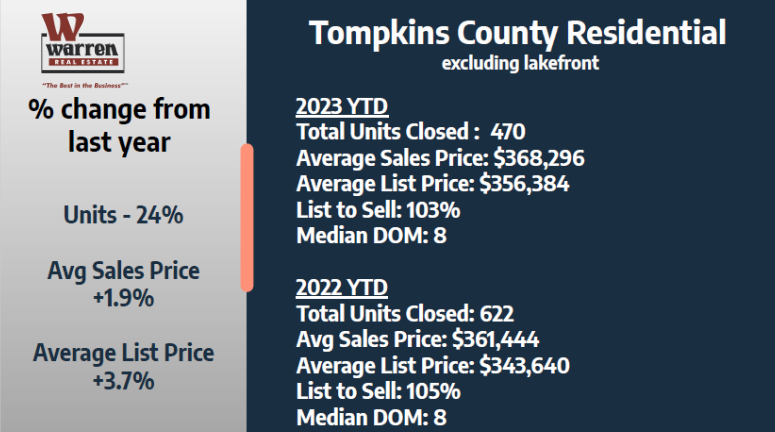

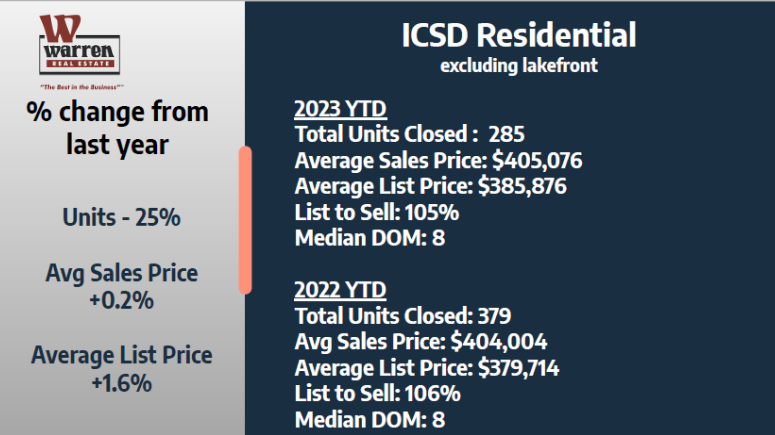

Indeed, locally, values and demand have remained strong, albeit softened from the prior few years. For instance, YTD average residential price growth has slowed to under 2% in Tompkins County, and is nearly flat within the Ithaca City School District, as these two charts demonstrate.

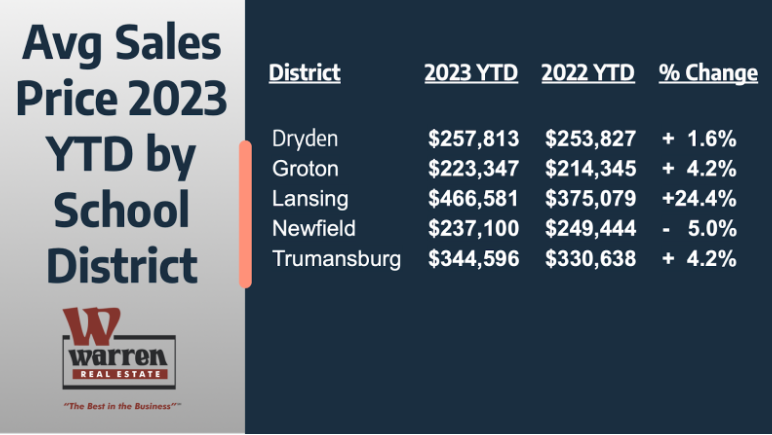

Of course, not all properties and not all market areas are created equal. As we look closer at our neighboring school districts, we see some real differences. For instance, Trumansburg, Lansing, and Groton all experienced stronger increases in sale prices through 3Q.

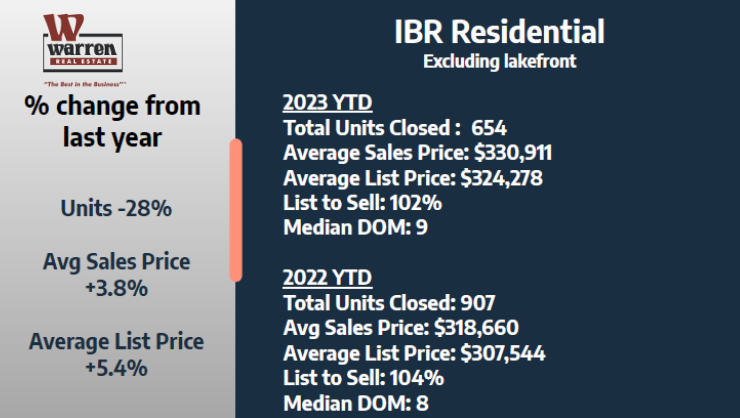

Further, in aggregate, the overall market area we serve here (all or part of 6 counties) experienced a 3.8% increase in average sale price while 28% fewer properties were sold. This mirrors our experience with buyers who have expanded the geography of their home search as values in Ithaca became out of reach.

Are all price ranges seeing the same slowdown?

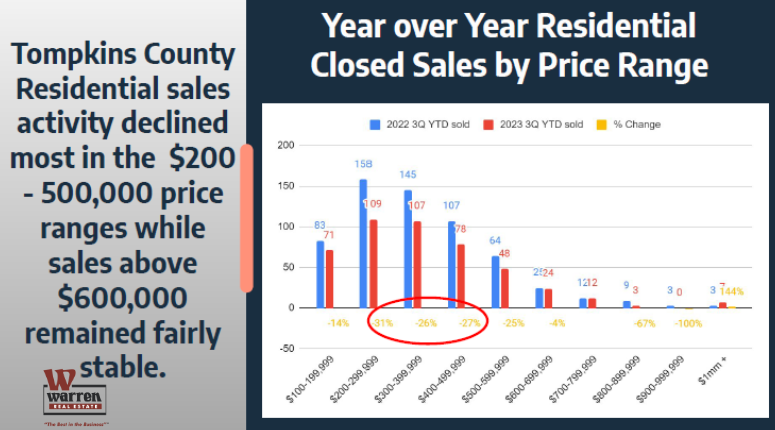

Price sensitivity has been most acute in the mid-market range where more buyers rely on financing to purchase their home and the competition remains the fiercest.

While small changes in available inventory can seem to present an outsized impact on the numbers (it’s easier to experience a 20% change when you’re counting 50 sales than when you’re counting 200), it’s still valuable to look a bit more granularly at important measures, including price ranges. For 3Q YTD, for instance, we’re seeing the greatest decline in sales activity in the $200,000 to $500,000 price range while activity above $600,000 has held fairly steady.

Is this just a seasonal slowdown, like we used to see regularly?

Perhaps you’ve noticed price drops on multiple properties, and in multiple areas in the county – for the first time in a very long time. The practice of price drops began to re-emerge in the 4Q2022, concurrent with the sharp escalation of mortgage rates, so the question of seasonality may have been masked then, unlike now.

There have been so many market forces in play in the past three years that pointing to anyone as particularly causal is a challenge. Lack of inventory, however, is clearly the big one, which no doubt is also influenced by high-interest rates keeping people in their homes.

What can home buyers and sellers expect in the months ahead?

Historically, November through January have been slower home sales months as households settle into the winter months, holidays, and school breaks and this season isn’t expected to differ from this pattern. Homebuyers are expected to continue to pull back for a time in hopes of a downshift in interest rates which now top 8% at many lenders. Likewise, unless sellers are faced with a life event requiring a move (job change, growing family, marriage, etc), the lack of available homes to move to and the comfort of a 3-4% existing mortgage is encouraging sellers to stay put as a more economically attractive choice than selling and buying elsewhere. Therefore, a surge in available inventory remains unlikely well into next year. Come springtime, with recent signs of market stabilization and inflationary pressures subsiding, we should see home values holding steady and REALTORSⓇ who are watching the market regularly will advise their clients to price their homes accordingly while home buyers adjust to the reality of 7% mortgages. Seeing some relief in their other household expenses and a continued desire to own in our market, Buyers are expected to resume their home search with perhaps a bit more leverage to negotiate than has been available for much of the past few years.

________

Author: Brent Katzmann

NYS Licensed Associate Broker, GRI, PSA, RSPS, CIPS

Office Manager

WARREN REAL ESTATE

830 Hanshaw Road, Ithaca, NY 14850

o: 607-257-0666 c: 607-280-8353

2022 REALTORⓇ of the YEAR Ithaca Board of REALTORS

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link