Ithaca Board of Realtors joins the New York State Alliance of MLS

Ithaca Board of Realtors joins the New York State Alliance of MLS

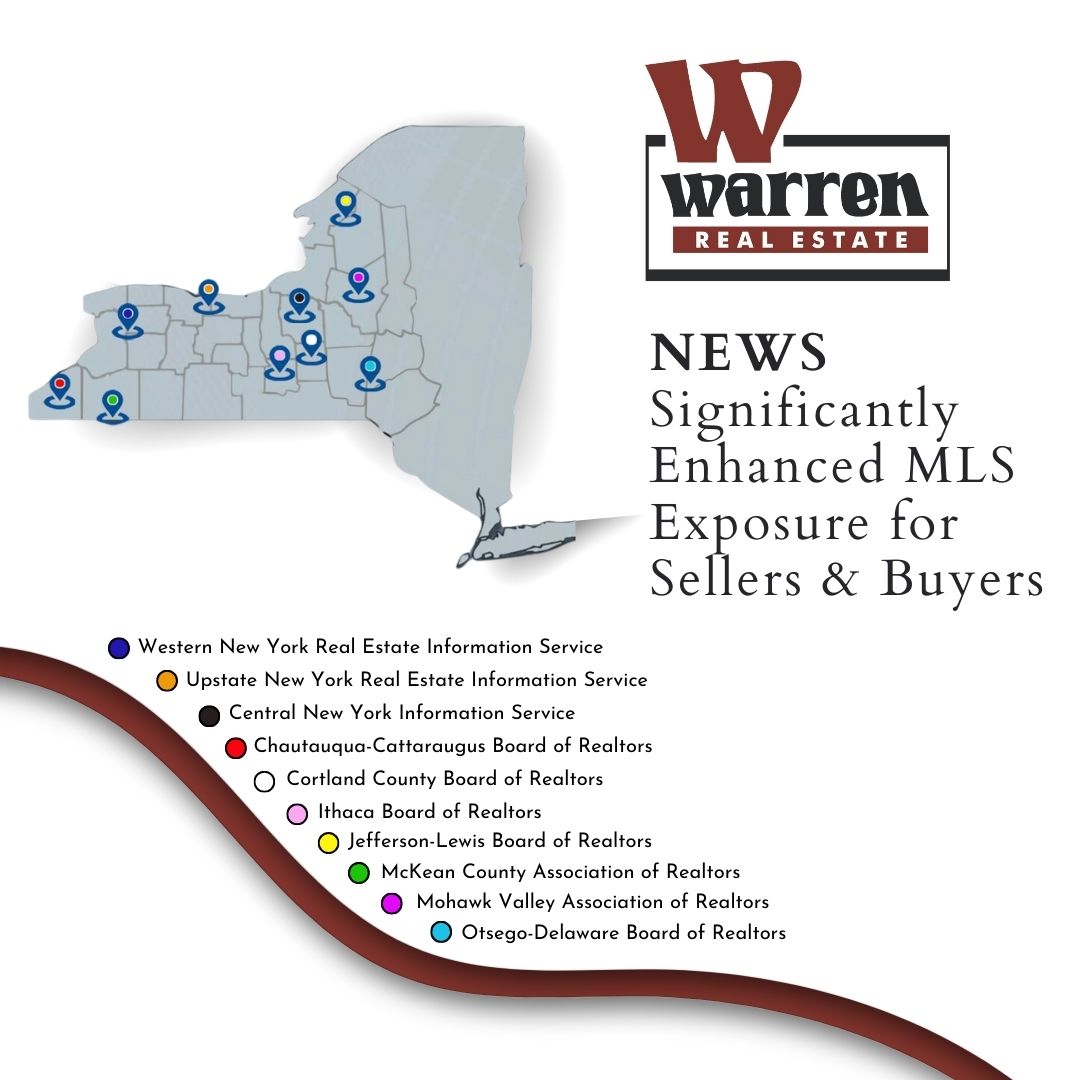

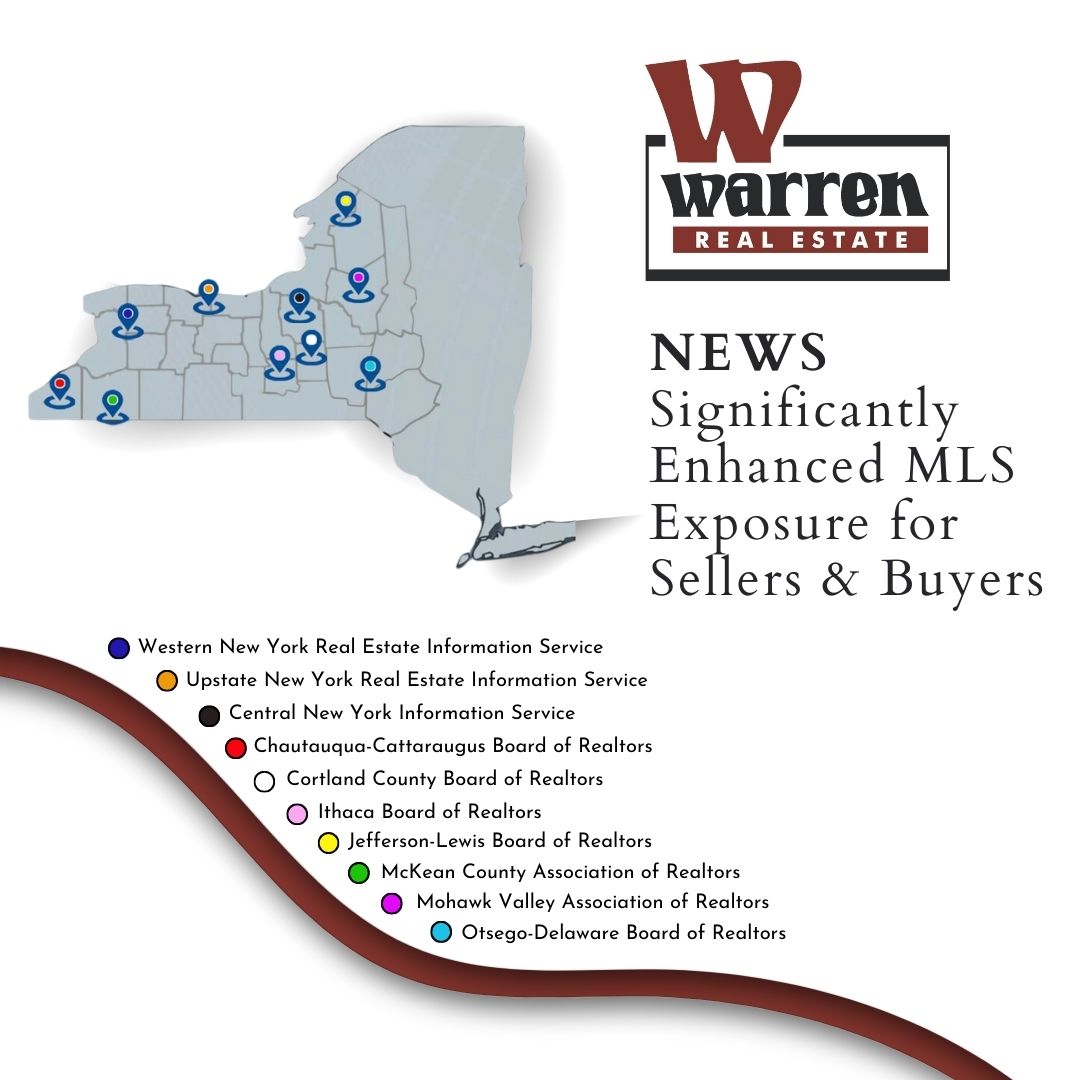

Warren’s affiliation with the New York State Alliance MLS (NYSAM) through the Ithaca Board of Realtors (IBR) now provides clients in our Ithaca Offices with significantly increased MLS exposure. By tapping into the combined listing data from the Buffalo-Niagara MLS, the Central New York Information Service (CNYIS), and the above boards, clients gain exposure and access to a tremendous footprint across New York State. This means our Sellers’ properties are searchable on all the above boards and our Buyers have access to all the listing data in the above areas.

Tompkins County Assessment – Formal Assessment Review Deadline is April 12, 2024

It is the season for assessment! The Tompkins County Assessment office sent out their Preliminary Property Value Assessment for all properties in the county for 2024. If you have not received yours, feel free to call the assessment office at 607- 274-5517.

Tompkins County re-values all properties in the County to assist local governments and school districts in determining the rate at which they need to tax local property owners to fund their annual budgets.

This year’s annual adjustment is sure to raise some eyebrows as the average assessed value in the preliminary assessment reflects a 19.8% increase over 2023. This is extraordinary and on top of an average increase in 2023 of 10%.

Releasing the preliminary assessments is the first step in a weeks-long process of review and opportunities for property owners to challenge the County’s determination of value. While the final assessed value is only one component of the formula to determine property and school tax rates (put simply: total property value divided by final municipal or school district budget = tax rate), it is the most visible expression of rising property values and sets the tone for conversations around housing affordability, challenges to investment and development of housing in the county, and reinforces the perception that New York is a high property tax state.

And, it also has already begun to stir social media commentary and conversations in the County. As such, if you feel as though your preliminary assessment is inaccurate or excessive, you do have a few avenues that you can pursue to both challenge and express concerns over, the value shown in your preliminary assessment.

- You can request an informal one-on-one review with the Assessment Office beginning now through April 12, depending on the location of your property (more detail below);

- You can apply for a formal review by the Assessment Department staff up to April 12 in hopes of reducing the assessed value when they publish the “tentative” assessments on May 1; and

- You can attend the Grievance Day hearing on May 23 and make a personal appearance before the Grievance Board. After that, the assessment values become final and are used to calculate the next round of municipal property tax and school tax rates.

Lastly, you can also attend any Tompkins County Legislature session (1st & 3rd Tuesdays at 5:30 pm) and use the public comment period or formally request to address the Legislature in advance or submit written comments of any length. Speaking at the Legislature is restricted to 3 minutes but is the most direct way to express your opinions and concerns to the body that governs the County operations, including the Assessment Office and the County’s own budgetary process. The next meetings during the assessment cycle will be on March 5, March 19, April 2, April 16, May 7, and May 21, 2024. If you do wish to speak at one of these meetings, instructions can be found on the County website here: https://tompkinscountyny.gov/legislature/publiccomment

While the assessed value of a property is something of a flashpoint for local concerns over rising values and taxes, please keep in mind that the assessed value does not determine the property and school taxes assigned to the property. ONLY the amount of money the school district, county, and municipality require to fund their annual budgets does that. All the assessed value does is impact the resultant rate that the taxing authorities use to collect their money. A higher assessment means a lower tax rate while a lower assessment means a higher rate. Either way, the actual amount of the taxes due doesn’t change.

What this means is that when there are opportunities to talk to the taxing authorities (county and local governments and district school boards) during their annual budgeting process (and subsequent votes), this is when the total monies they seek to generate from property taxes are determined and is arguably the most impactful time to make a difference in your tax bills.

In the meantime, to help you guide your through the assessment grievance process, here are the target dates by municipality for mailing of notices and scheduling grievance reviews:

| Municipality | Date of Mailing | Start of Appointments | End of Appointments | Last Day to Submit Review |

| Caroline | 03/22/2024 | 04/01/2024 | 04/12/2024 | 04/12/2024 |

| City of Ithaca | 03/22/2024 | 04/01/2024 | 04/12/2024 | 04/12/2024 |

| Danby | 03/15/2024 | 03/25/2024 | 04/05/2024 | 04/12/2024 |

| Dryden | 02/23/2024 | 03/04/2024 | 03/15/2024 | 04/12/2024 |

| Enfield | 03/01/2024 | 03/11/2024 | 03/22/2024 | 04/12/2024 |

| Groton | 03/08/2024 | 03/18/2024 | 03/29/2024 | 04/12/2024 |

| Town of Ithaca | 03/15/2024 | 03/25/2024 | 04/05/2024 | 04/12/2024 |

| Lansing | 03/08/2024 | 03/18/2024 | 03/29/2024 | 04/12/2024 |

| Newfield | 03/01/2024 | 03/11/2024 | 03/22/2024 | 04/12/2024 |

| Ulysses | 02/23/2024 | 03/04/2024 | 03/15/2024 | 04/12/2024 |

The Formal Assessment Review Deadline is April 12, 2024

The first opportunity to argue the assessment is through one-on-one reviews with the Assessment office staff. These appointments are available as early as the first week of March, depending on the property location as shown in the chart above. This is an opportunity to present any useful information that the staff may consider to re-value the property before the final assessment is issued.

However, property owners can also request a formal review by written application. The Preliminary Review application must be filed with the Tompkins County Assessment Office by Friday, April 12th to allow the appraisers time to prepare the Tentative Assessment Roll. Tentative assessment notices will then be mailed on or about May 1.

To help you with this process, the 2024 Preliminary Assessment roll is available here and viewable at https://tompkinscountyny.gov/assessment

You can complete a formal Assessment Review Application (due April 12) online – click here or download an Assessment Review Application – click here.

Once the Tentative Assessment rolls are published on May 1, there is one last formal Assessment Appeal process that takes place on May 23 by personal appearance on Grievance Day.

Please reach out and let us know if you’d like our assistance in reviewing your property assessment or simply are seeking advice on whether and how to appeal. While we can certainly review market data to determine whether the proposed assessment seems aligned with current values, you may also wish to hire a licensed appraiser which, historically, has seemed to hold greater weight in arguing value since it is presented by a licensed 3rd party reviewer and is approached very similarly to the way the County Assessment Office values properties.

If you have any other questions about this – feel free to reach out to our Ithaca offices.

The Timeless Appeal of Historic Homes: Exploring the Charm and Character

In a world where modern architecture often dominates the landscape, there’s something undeniably enchanting about historic homes. At Warren Real Estate, we appreciate the timeless appeal of these architectural treasures. In this blog post, we’ll take a journey back in time to explore the charm and character of historic homes, and why they continue to capture the hearts of homeowners and buyers alike.

- Architectural Elegance: Historic homes boast architectural details that are often unmatched in modern construction. From intricate woodwork and stained glass windows to grand staircases and ornate moldings, these features showcase the craftsmanship of bygone eras. We’ll delve into the architectural styles that define different periods of history, from Victorian and Colonial to Craftsman and Tudor, highlighting the unique characteristics that make each style special.

- Rich History and Heritage: Every historic home has a story to tell, weaving together the lives of past inhabitants with the cultural and social history of its surroundings. We’ll uncover the fascinating histories behind iconic properties, from former residences of prominent figures to homes that have witnessed significant events. Owning a piece of history not only connects you to the past but also allows you to become a custodian of heritage for future generations.

- Timeless Aesthetic Appeal: There’s an enduring elegance to historic homes that transcends trends and fads. Whether it’s the graceful symmetry of Georgian architecture or the whimsical charm of a Victorian cottage, these homes exude a sense of timelessness and refinement. We’ll explore how the classical proportions, graceful lines, and authentic materials of historic homes create an aesthetic that never goes out of style.

- Character and Quirks: One of the most endearing qualities of historic homes is their character and quirks. From sloping floors and cozy alcoves to hidden passages and secret gardens, each home has its own unique personality waiting to be discovered. We’ll celebrate the idiosyncrasies that give historic homes their charm, offering tips on how to preserve and enhance these distinctive features.

- Renovation and Restoration: Restoring a historic home to its former glory requires careful consideration and attention to detail. We’ll discuss the challenges and rewards of renovating historic properties, from navigating preservation guidelines to sourcing period-appropriate materials. Whether you’re restoring a neglected gem or simply updating a well-loved home, we’ll provide guidance on how to honor the integrity of the original design while incorporating modern amenities for contemporary living.

- A Lasting Legacy: Owning a historic home is not just about living in a beautiful space – it’s about being part of a legacy that transcends generations. We’ll explore the emotional significance of passing down a piece of history to future heirs, fostering a sense of continuity and connection that spans time.

Historic homes are more than just architectural artifacts – they are living testaments to the past, imbued with stories, character, and a sense of belonging. At Warren Real Estate, we celebrate the enduring allure of historic properties and the unique opportunity they offer to experience the richness of history firsthand. Whether you’re drawn to the grandeur of a Victorian mansion or the simplicity of a colonial farmhouse, we’re here to help you find the perfect historic home that speaks to your soul and enriches your life for years to come.

Embracing the Future: Smart Home Features That Add Value

As technology continues to advance, homes are becoming smarter and more connected than ever before. At Warren Real Estate, we recognize the growing importance of smart home features in the real estate market. In this blog post, we’ll explore how embracing the future with these innovative technologies can not only enhance your daily life but also add significant value to your property.

- Smart Security Systems: Safety is a top priority for homeowners, and smart security systems provide an extra layer of protection. From smart doorbell cameras that allow you to see who’s at your doorstep to comprehensive home security systems with remote monitoring, we’ll delve into the various options available. These features not only provide peace of mind but can also be attractive selling points for potential buyers.

- Energy-Efficient Smart Thermostats: Energy efficiency is not only good for the environment but also for your wallet. Smart thermostats learn your heating and cooling preferences, adapting to your lifestyle to maximize energy savings. We’ll discuss the benefits of these devices, from reducing utility bills to attracting environmentally conscious buyers.

- Automated Lighting and Smart Bulbs: Customizable lighting can transform the ambiance of a home, and smart lighting solutions allow you to control your lights remotely. Whether it’s setting the mood for a cozy evening or ensuring your home is well-lit when you return, we’ll explore how automated lighting can add convenience and appeal to your property.

- Integrated Smart Home Hubs: Centralized control hubs, such as smart home assistants, bring together various devices and systems in your home. We’ll discuss the advantages of having a centralized hub that allows you to control everything from lighting and security to thermostats and entertainment systems. This integration not only enhances the functionality of your home but also positions it as a tech-savvy property.

- Smart Appliances in the Kitchen and Beyond: The kitchen is often considered the heart of the home, and smart appliances can make it even more efficient. From refrigerators that help you manage grocery lists to smart ovens that can be controlled remotely, we’ll explore how these high-tech features can add value to your home.

- Voice-Activated Technology: Voice-activated assistants like Amazon Alexa and Google Assistant have become increasingly popular. We’ll discuss how incorporating these technologies into your home can streamline daily tasks, enhance accessibility, and create a modern, connected living experience.

Embracing smart home features is not just about keeping up with trends – it’s about enhancing your lifestyle and increasing the appeal of your property in a tech-driven world. At Warren Real Estate, we understand the value these innovations bring to the real estate market. Whether you’re looking to upgrade your current home or considering these features for a future sale, integrating smart home technologies is a forward-thinking investment that can elevate your living experience and attract discerning buyers.

The Art of Home Staging: Elevate Your Property’s Appeal

At Warren Real Estate, we understand the power of first impressions when it comes to selling your home. In this blog post, we’ll explore the art of home staging – a strategic approach that can significantly enhance your property’s appeal, captivate potential buyers, and ultimately lead to a quicker and more lucrative sale.

- Curb Appeal Matters: The journey to a potential buyer’s heart begins at the curb. Boosting your home’s curb appeal creates an instant positive impression. From well-maintained landscaping to a fresh coat of paint on the front door, we’ll share practical tips on how to make your property stand out from the moment a buyer arrives.

- Declutter and Depersonalize: Prospective buyers want to envision themselves living in your home. To facilitate this, decluttering and depersonalizing are crucial steps in the staging process. We’ll guide you on how to showcase the space and allow buyers to imagine their own lives unfolding within the walls of your home.

- Maximize Natural Light: Natural light can transform a space, making it feel more open, inviting, and desirable. We’ll provide insights into optimizing natural light, from choosing the right window treatments to strategically placing mirrors. A well-lit home not only looks more appealing but also creates a positive atmosphere for potential buyers.

- Furniture Arrangement and Room Flow: Effective furniture arrangement can make a significant difference in how buyers perceive the size and functionality of your home. We’ll share tips on arranging furniture to maximize space, create a sense of flow, and highlight key features. Thoughtful layout decisions can make your property more memorable to potential buyers.

- Neutral Tones and Accents: Neutral color palettes appeal to a broader range of buyers, allowing them to envision their own style within the space. We’ll discuss the impact of neutral tones on a property’s marketability and how to use accents strategically to add personality without overwhelming potential buyers.

- Showcase Unique Features: Every home has unique features that set it apart. Whether it’s a cozy fireplace, stunning architectural details, or a picturesque view, we’ll guide you on how to showcase these features to their full potential. Highlighting what makes your home special can leave a lasting impression on potential buyers.

Home staging is a powerful tool in the real estate market, and at Warren Real Estate, we’re here to help you master the art of presenting your property in the best light possible. By incorporating these home staging tips, you’ll not only increase the attractiveness of your home but also create an environment that resonates with potential buyers. Let your property shine and make a lasting impression on the competitive real estate market.

Navigating the Real Estate Market: A Guide to Making Informed Decisions

Welcome to Warren Real Estate, your trusted partner in the dynamic world of real estate. Whether you’re a seasoned investor or a first-time homebuyer, the real estate market can be both exciting and overwhelming. In this blog post, we’ll guide you through key aspects of the real estate landscape, providing insights to help you make informed decisions.

Understanding Market Trends:

The real estate market is constantly evolving, and staying informed about current trends is crucial. At Warren Real Estate, our experts analyze market data regularly to keep you updated on the latest developments. From fluctuating home prices to emerging neighborhood trends, our goal is to empower you with the knowledge needed to make strategic decisions.

Financing Options and Mortgage Rates:

One of the most critical aspects of any real estate transaction is securing the right financing. Understanding the financial landscape will empower you to make decisions that align with your long-term goals.

Neighborhood Insights:

Choosing the right neighborhood is as important as finding the perfect property. Our goal is to help you find a home that not only meets your needs but also fits seamlessly into your lifestyle.

Navigating the Buying and Selling Process:

Buying or selling a property involves a series of steps that can be complex for those unfamiliar with the process. We’ll break down each stage, offering practical tips and guidance to streamline your experience. From preparing your home for sale to negotiating the best deal, Warren Real Estate is here to support you every step of the way.

Investment Strategies:

For those looking to build wealth through real estate, we’ll explore various investment strategies. Whether you’re interested in rental properties, fix-and-flip projects, or long-term appreciation, our blog will provide insights into maximizing your return on investment.

Legal and Regulatory Considerations:

Real estate transactions come with legal and regulatory considerations that vary by location. We’ll shed light on common legal aspects, ensuring you are well informed and prepared for a smooth transaction.

Warren Real Estate is committed to providing you with the knowledge and resources needed to navigate the real estate market successfully. Stay tuned for regular updates, expert insights, and valuable tips that will empower you to make confident decisions in your real estate journey. Remember, when it comes to real estate, knowledge is key, and we’re here to be your trusted guide.

Have We Turned a Corner for 2024?

Have We Turned a Corner for 2024?

As we wind down a challenging year in real estate, we have an opportunity to reflect on the obstacles and difficulties the market presented to our clients and customers and begin to gain perspective on how 2024 might play out.

Declining Inventory and Rising Rates – A Tough Market for Buyers, and Sellers

It is no secret that those who have been trying to sell a home in 2023 experienced some conditions that seem to contradict each other resulting in a softening of the recent rise in home values. For one, a strong continued decline in the number of homes offered for sale in 2023 would suggest that buyers would once again be competing to secure a home and consequently drive prices higher. And indeed, this was true, but it was more limited than we’ve experienced in the past 3 years.

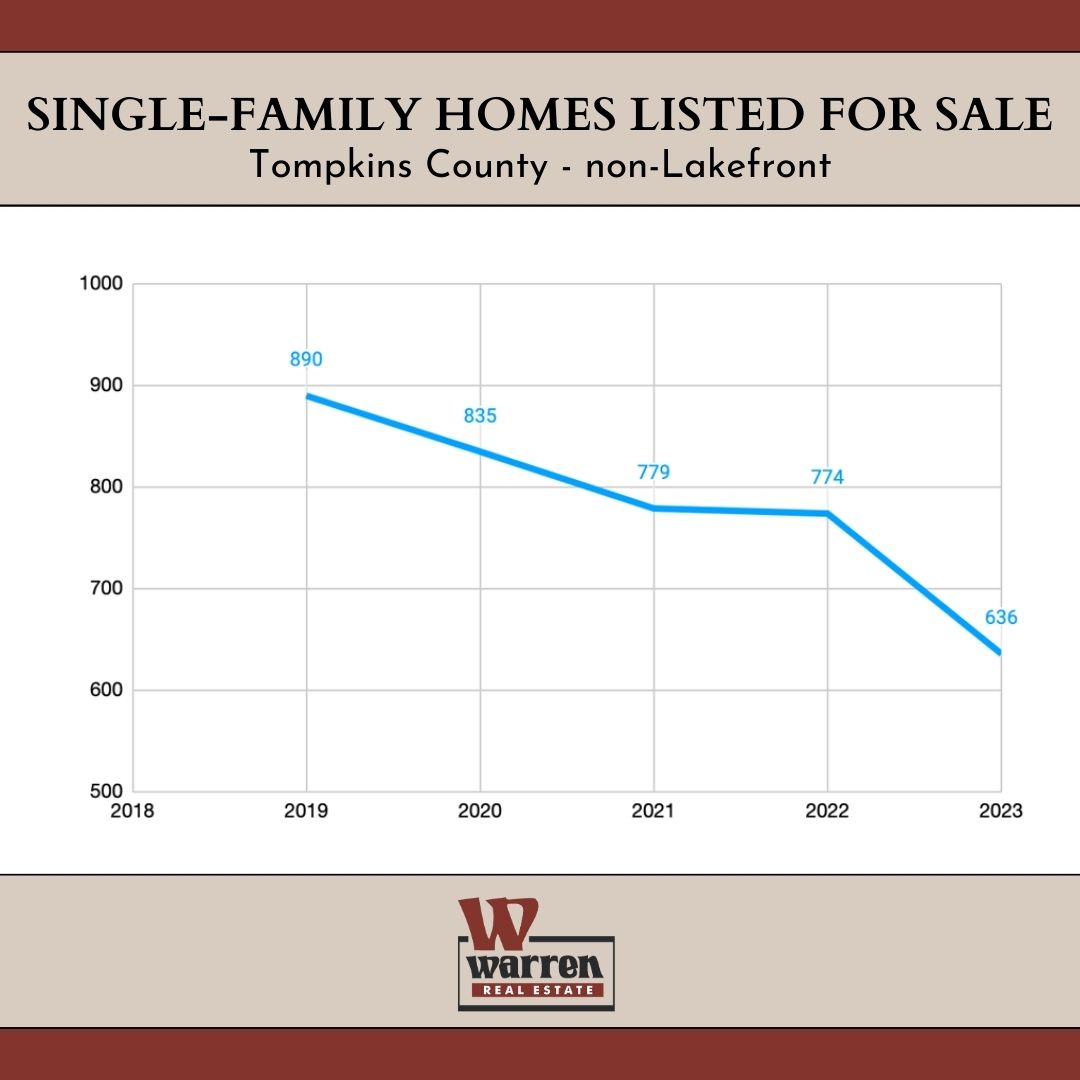

In 2023, there was an 18% decline in the number of homes listed in Tompkins County from 2022, and was the fourth straight year of declining inventory.

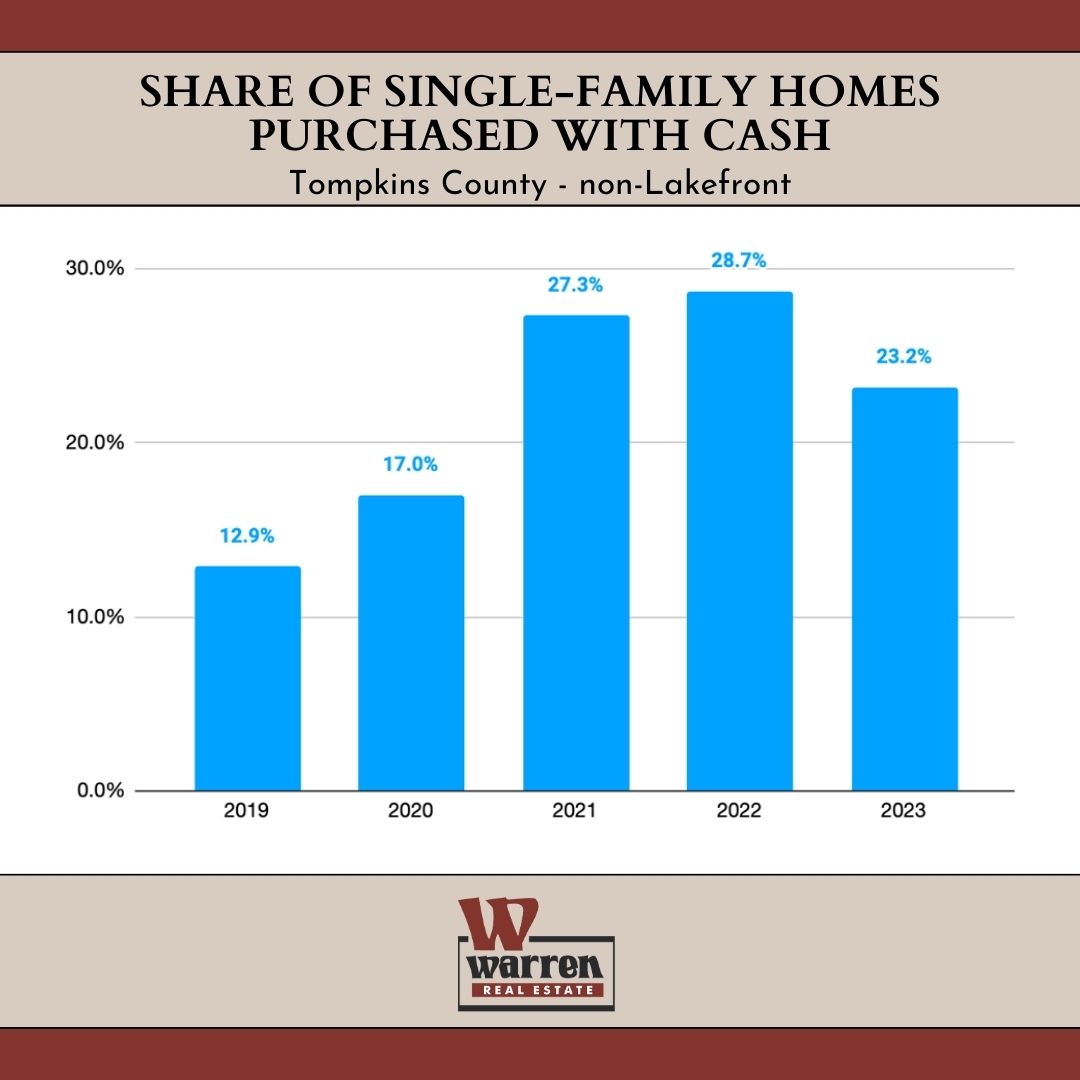

While it is also true that interest rates really began their climb in 2022, the impact was rather muted as cash continued to play a significant role in propelling sales and, therefore, market value. A cash buyer almost universally would beat out a financed buyer as there was less risk to the home seller, and often would be willing to pay more. But the era of “cash is king” that reigned for much of 2020 through 2022 seems to have weakened in 2023, giving financed buyers a bit more leverage, or at least greater ability to compete.

Home Values increased at a slightly softer rate.

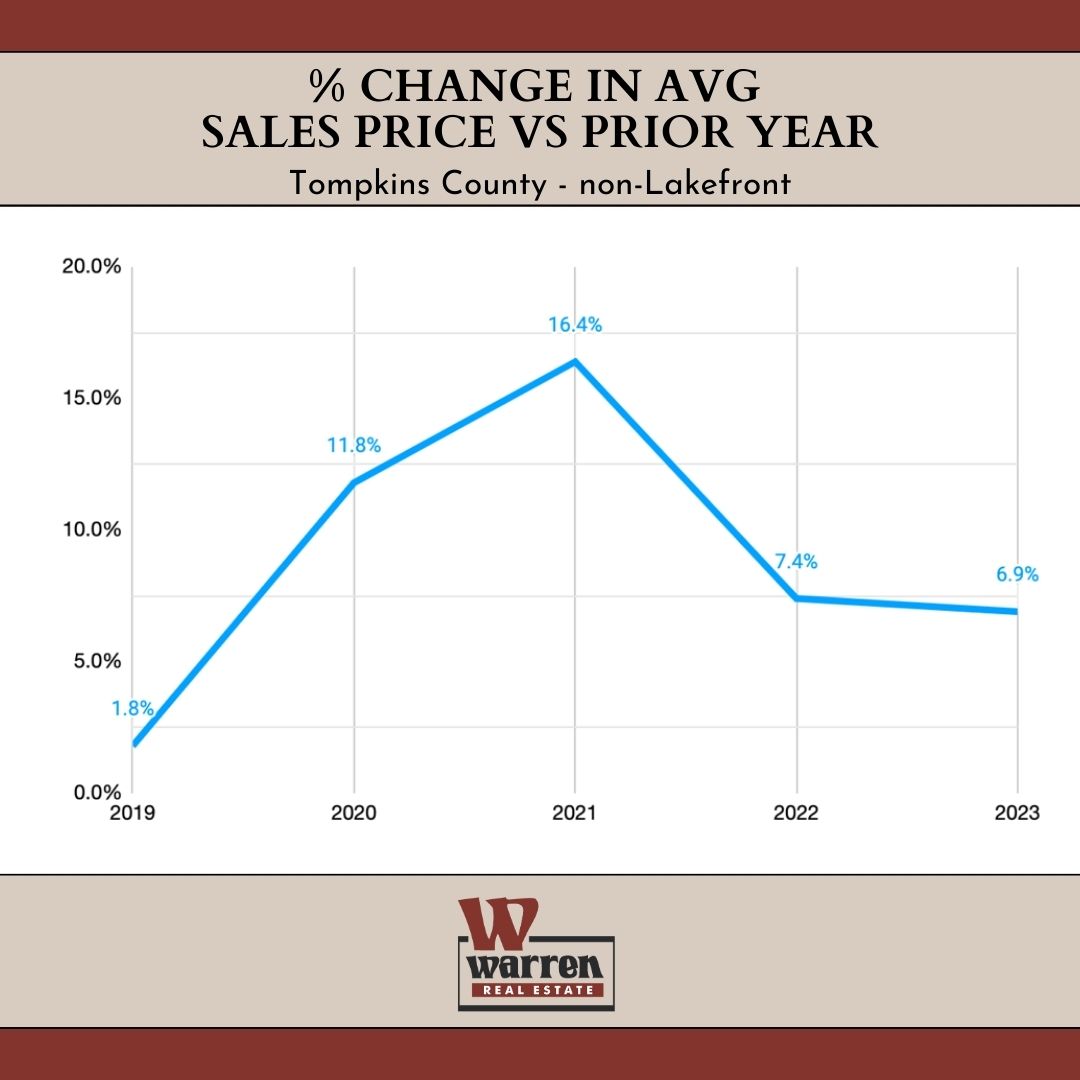

However these buyers also had limitations on how much they could borrow as prices remained strong and lenders required appraisals to support the value being borrowed. As a result, sellers who had been seeing dollar signs the previous three years began experiencing the limits of price elasticity and seem to be becoming more accustomed to the idea that value growth is softening. 2023 marked the second year of softening increases in home prices with an increase of just below 7% in Tompkins County.

So, what does all of this mean for 2024? Overall, we’re optimistic.

Given the market fluctuations and competing forces on real estate values, it’s impossible to forecast with any certainty where we’ll end up in a year, but looking at the fundamentals of inventory, interest rates, and market economy, a picture seems to be emerging.

First, inventory remains at historic lows. The rapid development of market-rate rental housing in our area, including senior housing such as Library Place may begin to bring some local homes onto the market. Increased rental inventory coupled with growing regulations impacting short-term rental potential may also begin to encourage some local property investors to sell off part of their portfolios. However, neither of these scenarios is enough to offer any significant relief in available inventory. A sustained effort at the creation of new, owner-occupied for sale housing across a range of price points throughout the county is still a critical need to begin to balance the market and create opportunities for first-time and modest-income buyers.

Second, interest rate stabilization and potential further declines should begin to reset and establish a new reality facing both sellers and buyers. Rates have declined for 9 weeks in a row and locally 30 year fixed rates are again moving downward towards 6% from a high of over 8%. Interest rates are low by historical standards and at some point, both buyers and sellers may find that keeping their other life plans on hold while awaiting further declines may not be satisfying. Between the rapid growth in equity, sellers have accumulated in the past three years and the gradual decline in inflation and mortgage rates coupled with growing incomes for many buyers, their purchasing power should improve and help encourage those who have been sidelined to re-enter the market.

Look for our 2024 Market Report coming out later this month with data covering a wide range of property types, local school districts, and overall market performance from 2023. And be sure to reach out to your Warren Real Estate agent for more insights into the local market and experienced support in your home sale or purchase. In this challenging market, it pays to work with a licensed professional to help ensure that you have the information and resources you need to meet your goals.

Written by: Brent Katzmann, Warren Real Estate

(All data sourced from the Ithaca Board of REALTORSⓇ MLS based on results from 1/1 through 12/31 of each year reported. Data is believed to be accurate but not guaranteed.)

Inventory is Low, Prices are High. Where do we go from here?

Inventory is low. Prices are high. Where do we go from here?

As real estate professionals, we are often faced with the question, “So, how’s the market?” For the past three years, the answer has been pretty consistent: “Demand is high, inventory is low, and prices are escalating quickly.”

And with seasonality patterns by the wayside and a pandemic fueling work-from-home careers, it didn’t matter what time of year the conversation occurred.

However, we started to see the change a year ago, in 3Q2022.

While demand remained strong, rising interest rates and increased values served as a double hit on many would-be homebuyers, increasing their cost of borrowing and decreasing their purchasing power. The number of multiple offer sales showed some modest decline and, occasionally, a property would require a price drop to stimulate a sale. Now that we’re one year into this pattern we can better track YTD trends more closely vs the same period last year and answer a new question.

Is the market slowing?

National data from the National Association of REALTORS® certainly seems to say so, with the total number of home sales falling to below a 4 million unit annual average for the first time since the Great Recession of 2008. But, is that universally true? If we define “softening” as a decline in activity, then yes, clearly our market is also experiencing a downward shift driven largely by our substantial supply issue. However, buyer activity has held up, until very recently.

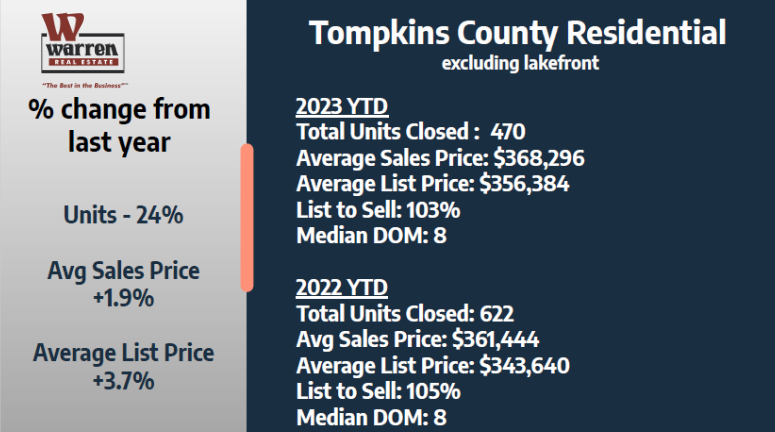

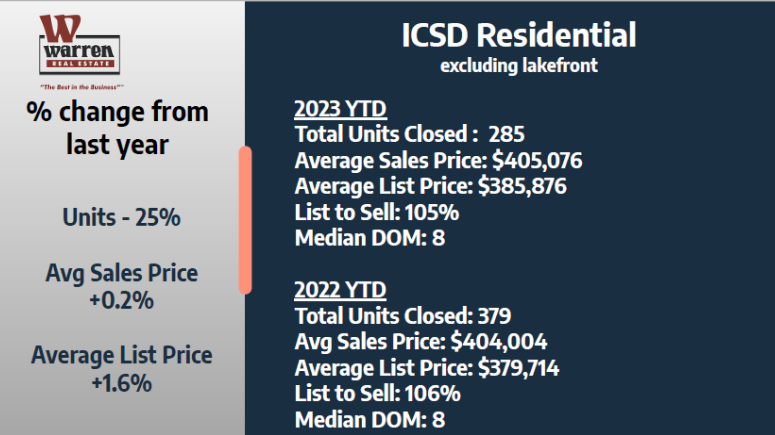

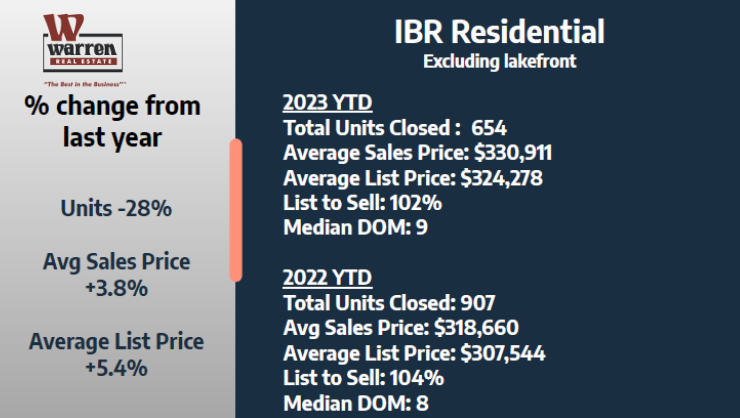

Indeed, locally, values and demand have remained strong, albeit softened from the prior few years. For instance, YTD average residential price growth has slowed to under 2% in Tompkins County, and is nearly flat within the Ithaca City School District, as these two charts demonstrate.

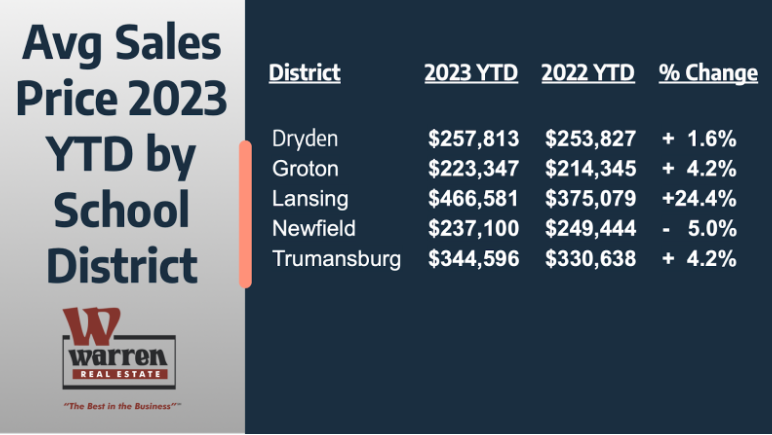

Of course, not all properties and not all market areas are created equal. As we look closer at our neighboring school districts, we see some real differences. For instance, Trumansburg, Lansing, and Groton all experienced stronger increases in sale prices through 3Q.

Further, in aggregate, the overall market area we serve here (all or part of 6 counties) experienced a 3.8% increase in average sale price while 28% fewer properties were sold. This mirrors our experience with buyers who have expanded the geography of their home search as values in Ithaca became out of reach.

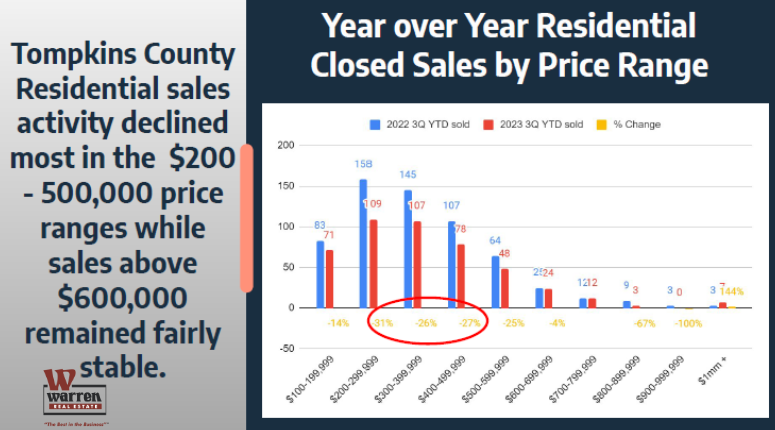

Are all price ranges seeing the same slowdown?

Price sensitivity has been most acute in the mid-market range where more buyers rely on financing to purchase their home and the competition remains the fiercest.

While small changes in available inventory can seem to present an outsized impact on the numbers (it’s easier to experience a 20% change when you’re counting 50 sales than when you’re counting 200), it’s still valuable to look a bit more granularly at important measures, including price ranges. For 3Q YTD, for instance, we’re seeing the greatest decline in sales activity in the $200,000 to $500,000 price range while activity above $600,000 has held fairly steady.

Is this just a seasonal slowdown, like we used to see regularly?

Perhaps you’ve noticed price drops on multiple properties, and in multiple areas in the county – for the first time in a very long time. The practice of price drops began to re-emerge in the 4Q2022, concurrent with the sharp escalation of mortgage rates, so the question of seasonality may have been masked then, unlike now.

There have been so many market forces in play in the past three years that pointing to anyone as particularly causal is a challenge. Lack of inventory, however, is clearly the big one, which no doubt is also influenced by high-interest rates keeping people in their homes.

What can home buyers and sellers expect in the months ahead?

Historically, November through January have been slower home sales months as households settle into the winter months, holidays, and school breaks and this season isn’t expected to differ from this pattern. Homebuyers are expected to continue to pull back for a time in hopes of a downshift in interest rates which now top 8% at many lenders. Likewise, unless sellers are faced with a life event requiring a move (job change, growing family, marriage, etc), the lack of available homes to move to and the comfort of a 3-4% existing mortgage is encouraging sellers to stay put as a more economically attractive choice than selling and buying elsewhere. Therefore, a surge in available inventory remains unlikely well into next year. Come springtime, with recent signs of market stabilization and inflationary pressures subsiding, we should see home values holding steady and REALTORSⓇ who are watching the market regularly will advise their clients to price their homes accordingly while home buyers adjust to the reality of 7% mortgages. Seeing some relief in their other household expenses and a continued desire to own in our market, Buyers are expected to resume their home search with perhaps a bit more leverage to negotiate than has been available for much of the past few years.

________

Author: Brent Katzmann

NYS Licensed Associate Broker, GRI, PSA, RSPS, CIPS

Office Manager

WARREN REAL ESTATE

830 Hanshaw Road, Ithaca, NY 14850

o: 607-257-0666 c: 607-280-8353

2022 REALTORⓇ of the YEAR Ithaca Board of REALTORS

FOR OUR ITHACA CLIENTS – RAPATTONI UPDATE

FOR OUR ITHACA CLIENTS – RAPATTONI OUTAGE

Dear Valued Ithaca Clients and Customers,

Rapattoni, the production network of Ithaca Multiple Listing Service (MLS), was victim to a cyber-attack and has been down since last Wednesday, August 9th, 2023. Rappatoni and the Ithaca Board of Realtors are working diligently around the clock to get systems restored as soon as possible. They are actively investigating the nature and scope of the event. The confidentiality, privacy, and security of information in their care is one of their highest priorities. All technical resources are devoted to this effort.

- For Buyers that receive automatic notification emails from the Ithaca Board of Realtors, you will not receive any notifications until the outage is restored.

- There is a NEW LISTINGS button on our homepage, warrenhomes.com, it is automatically sorted by “time on market” – you are welcome to check this daily.

- You and your agent still have access to all syndicated websites like Warrenhomes.com, realtor.com, and zillow.com for searching. They include all current market information except status changes (price, pending contracts, etc) for properties listed before Wed, 8/9/23,

- Your agent may need additional time to schedule a showing and/or collect disclosure/further information.

Sellers

- Your Warren agent can still provide a Comparative Market Analysis (CMA) to help you price your property but they may need to use multiple platforms.

- For new listings, the Rochester Board of Realtors has generously offered to allow our listings to be input on their MLS which will provide syndication to all websites, allowing new listings to appear online for those searching in Ithaca and surrounding areas. Rochester MLS has some additional information fields including, but not limited to annual taxes. Please help provide information to your agent if asked. These new listings are limited to 4 photos at this time.

- For properties listed before Wed 8/9/23, status changes (price changes, pending contracts, expired, withdrawn, back on market) will not appear online until the outage is restored but all Warren agents are notified of status changes daily.

We are hopeful that this situation will be resolved soon and thank you for your understanding and patience. We will keep you updated as we get more information.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link